Laurent Bernut was a systematic short seller with Fidelity for 8 years. His mandate was to underperform the longest bear market in modern history: Japanese equities.

Prior to that, he worked in the Hedge Fund world for 5 years.

He now runs an automated Forex strategy and travels the world with his family.

In this episode we talk all about Short selling, creating shorting strategies, the challenges of implementation and how to manage risk. We also discuss the importance of exits, insights into Bear markets, autotrading Forex and why complexity is a form of laziness.

Show your support

While you’re listening, it would be great if you could show your support by leaving a brief review of the podcast in iTunes. This really helps to spread the word and reach even more listeners!

Topics discussed

- The benefits of developing a strategy on the short side first and why long/short symmetry is important

- Challenges with executing short systems and solutions

- The most important aspect to worry about when short selling

- Finding short candidates in a Bull market and why you should ignore absolute performance

- Tips to creating profitable short strategies

- The importance of exits and how to test them

- Insights into Bear markets

- The 3 wrong questions to ask during a Bear market and the 3 best ones to ask

- A simple method to identifying Bull and Bear markets

- Why complexity is a form of laziness

- Using MT4 as a professional trading platform

- Why being disciplined is a myth

- The type of strategies that work in the Forex markets

- The Common sense Ratio and why it’s more robust than the Sharpe ratio

Resources mentioned in this episode

- Laurent can be followed on his website Alphasecurecapital.com or on Quora

- Check out this excellent article from Laurent called ‘Regardless of the asset class, there are only two types of investment strategies.’

- Recommended books:

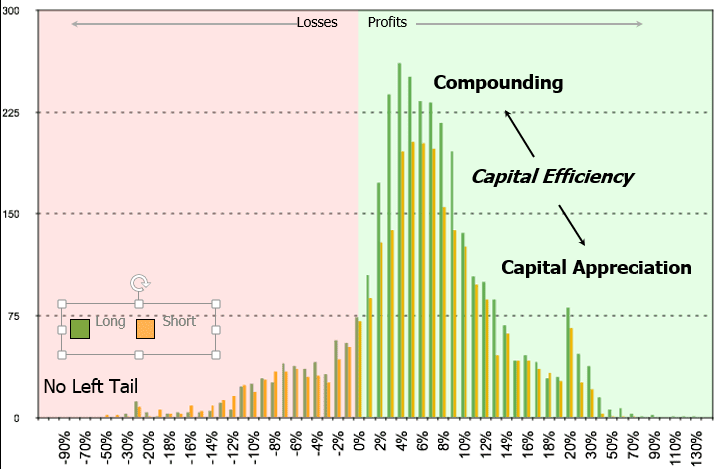

Free download – Trading Edge Visualiser

Download a free copy of the Trading Edge Visualiser tool Laurent uses for his own trading:

Quotes

Top tips from this episode

Here are few of my favourite takeaways from the chat with Laurent this week:

- Short selling – there were so many tips on building short strategies I couldn’t go through them all again but I found it interesting that Laurent says that if you can build a positive expectancy on the short side, the long side will be easy

- The importance of exits – I really liked the quote ‘You can’t achieve superior performance simply by good entry’, which is an obvious statement but it’s also a good reminder on the important of exits and how they can impact trading results. There can often be too much focus on entries.

Got A Question, Topic or Guest you want to see on the Podcast?

Do you have a specific question, topic or guest you’d like to see on a future podcast episode?

Click here and submit your suggestion for a chance to have it featured on an upcoming podcast episode.

Get the Transcript

Subscribe to Better System Trader and never miss another episode!

Please support the podcast by giving an honest Rating/Review for the show on iTunes!