Trading is a risky business and so many people who enter the trading world fail, losing large amounts of money in the process.

Have you already lost a large sum of money or are you on the path to becoming another trading statistic? How do you know?

Brent Penfold from IndexTrader.com.au, who has been trading successfully since the 1980’s and was a guest in Episode 2 of the Better System Trader podcast here, believes “why people lose is essentially most people are clueless about this key concept, Risk of Ruin.”

Are you currently trading a system with money management that is destined to fail? To find out, you need to calculate your Risk of Ruin and we’re going to show you how.

What is Risk of Ruin?

Risk of ruin is the probability that you’ll lose so much money you can no longer continue trading. This doesn’t mean losing all of your trading capital, the ruin point is based on your own personal risk tolerance, so ruin to you could be 15%, it could be 50% or it could be 100%.

Calculating your own Risk of Ruin

The risk of ruin formula published by Perry Kaufman and discussed here and here uses the probability of a win to calculate the risk of ruin:

risk_of_ruin = ((1 – Edge)/(1 + Edge)) ^ Capital_Units

Edge is the probability of a win or the Win%.

Win% is only one small component of strategy performance results and really needs to be considered along with the Win/Loss ratio, or the size of the wins compared to the size of the losses, to give a true indication of how a strategy performs. There are many profitable trading systems that have a win% as low as 30% but the size of the wins are many times larger than the size of the losses so the strategy is still profitable over the long term.

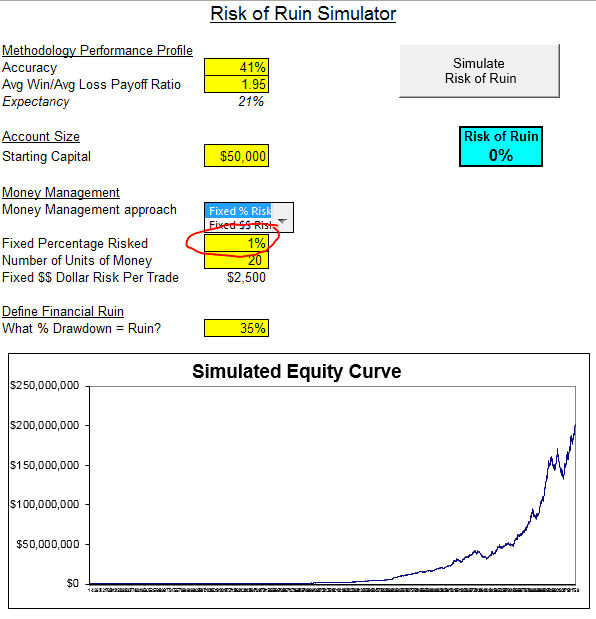

Including the Win/Loss ratio in the Risk of Ruin calculation makes the formula much more complicated so Brent Penfold from Indextrader.com.au has kindly provided the Risk of Ruin simulator he’s developed in Excel as a free download to Better System Trader podcast listeners. There is a link to download the simulator at the end of the article but let’s run through it first to see how it works and how we can apply the results to our own trading.

Using the free Risk of Ruin simulator

When you open the simulator, there are a few values you need to enter based on your trading strategy. (If it prompts you to enable the macros you will need to say yes otherwise the simulator won’t work).

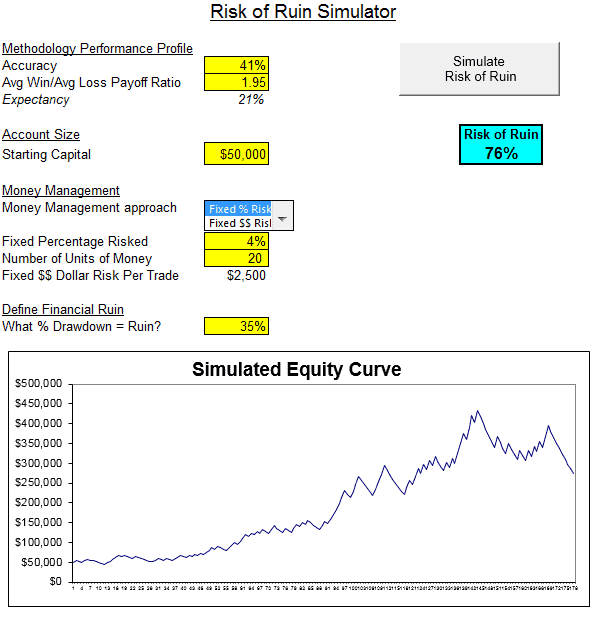

In this example I’ve entered the values for a trend following strategy:

- Win%: 41%

- Win/Loss ratio: 1.95

- Account size: $50,000

- Position size: 4% – We’re risking 4% of our capital on every trade

- Drawdown: 35% – We will not be able to trade this system if it has a drawdown greater than 35% so that is the point of “ruin”.

Push the ‘Simulate Risk of Ruin” button and the simulator will make a single run of trades based on your Win% and Win/Loss ratio until it reaches either the % Drawdown limit or the equity curve reaches 10,000 trades or $200 million, in which case it is assumed Ruin has been avoided.

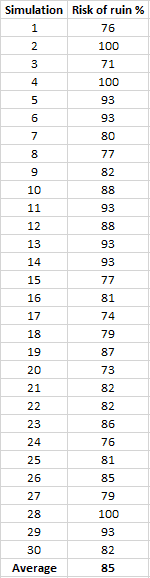

Immediately we can see with Accuracy of 41% and a Win/Loss ratio of 1.95 the Expectancy is 21% so the system itself has a positive expectancy but the Risk of Ruin is 76%. Keep in mind this is only a single run, so I’ve run 30 simulations and we see the results can often be worse with some runs producing a 100% Risk of Ruin:

The average Risk of Ruin over 30 simulations was 85% which is a guarantee we will meet the ruin point of 35% drawdown at some stage in the future.

Reducing your Risk of Ruin

There are 3 ways to reduce Risk of Ruin without adjusting the Drawdown level:

- Increase the Accuracy to a higher Win%,

- Improve the Win/Loss ratio so the winning trades are even larger than the losing trades,

- Reduce the amount of money risked on each trade.

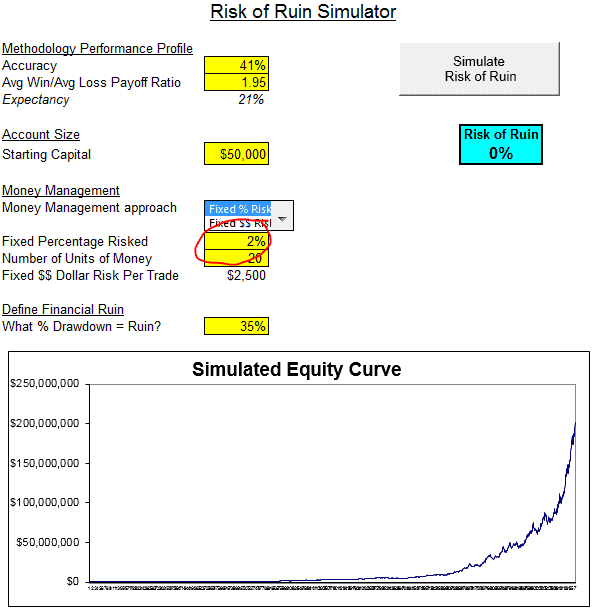

I’m actually happy with the Win% and Win/Loss ratio of this strategy so let’s investigate money management as a way to reduce the Risk of Ruin. We’re currently risking 4% of trading capital on each trade, let’s see how the risk of ruin changes if we reduce the risk to 2% per trade:

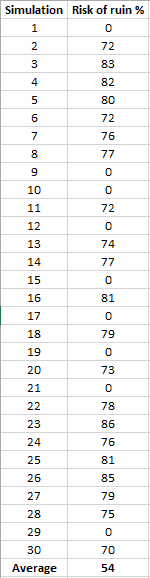

Risk of Ruin has now been reduced to 0% in this simulation but we can never know the order of trades that will occur in the future so we need to run multiple simulations, here are the results after 30 runs:

We can see that some simulations produced a Risk of Ruin of 0% but other runs had a Risk of Ruin of 70 – 80+% so the average over 30 runs was 54%. This is still too high because we can never know the order of trades we will experience in the future, we may get the run with 0% Risk or Ruin or we may get the run of trades with 86% Risk of Ruin.

Let’s try reducing the risk to 1% per trade.

Over 30 runs, the risk of ruin for each run was 0% so a 1% risk per trade is a more appropriate level of risk for this strategy. Of course this is no guarantee these are the results that will be achieved in the future but at least there is a better chance of survival by recognising the risk level was too high and reducing it to a level that is statistically more likely to succeed.

To summarise the results:

- Starting with a 4% risk per trade produced an average Risk of Ruin over 30 simulations of 85%,

- Reducing the risk per trade to 2% per trade produced a lower Risk of Ruin with the average over 30 simulations of 54%,

- Reducing the risk per trader to 1% per trader produced a Risk of Ruin of 0% over 30 simulations.

I highly recommend you complete this exercise for your own trading strategies to determine if you’re trading with too much risk.

Download it

DISCLAIMER: This simulator is provide for educational purposes only. It is provided as is, with no support. In no event shall IndexTrader or Better System Trader be liable for any special, incidental, indirect or consequential damages of any kind, or any damages whatsoever, including, without limitation, those resulting from loss of use, data or profits, whether or not advised of the possibility of damage, and on any theory of liability, arising out of or in connection with the use or performance of these files or other files which are referenced by or linked to this file. You should not assume that any of these files are error-free or that it will be suitable for the particular purpose which you have in mind when using it. We cannot guarantee that any files are free from computer viruses and no warranty is given that files downloaded or accessed from the Better System Trader website are free of computer viruses. We recommend scanning any file before opening it.

Want to get the latest updates automatically?

The best way to get notified when new stuff is released is to sign up to the email list below, we’ll be sure to let you know:

[mc4wp_form]