Ernie Chan is an expert in the application of statistical models and software for trading currencies, futures, and stocks. He has built and traded numerous quantitative models for investment banks and hedge funds.

He is now the Managing Member of QTS Capital Management, a commodity pool operator and trading advisor, managing a hedge fund as well as individual accounts.

Ernie is the author of 2 books, maintains a popular quantitative trading blog and teaches courses and workshops in trading and finance.

Today we talk about many aspects of quantitative trading, including how market crises impact momentum strategies and how to manage the impacts, when to use stop-losses and when they don’t make sense, automating trading, managing funds in a portfolio of strategies and a simple money management approach which aims to limit drawdowns while maximising returns.

Topics discussed

- Where to find trading ideas

- The first aspect of a market to identify before building a strategy for it

- Momentum crashes and the performance of momentum strategies after a financial crisis

- How to manage the times when momentum strategies aren’t working

- When stop losses should be used and when they don’t make sense

- How to limit drawdowns while maximising growth

- Factors to consider when automating your trading

- How independent traders can avoid competing with the big trading firms

- When you need to worry about market microstructure and when it doesn’t matter

- Managing funds for a multi-strategy portfolio

- The hardest part of trading

Resources & Links mentioned in this episode

- To learn more about Ernie and his work, checkout his websites Epchan.com and epchan.blogspot.com.

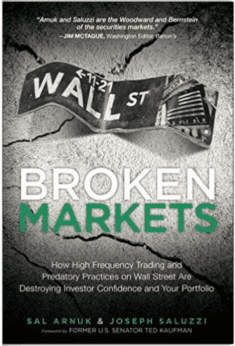

- Books:

- Additional Resources:

Quotes

Top tips from this episode

- Simple stuff works – Ernie has worked for some big name investment companies that had enormous resources, perhaps unlimited resources. In those environments he was exposed to the greatest minds and work but when he went out on his own he chose the simple stuff. He wasn’t out to impress anyone with complicated strategies, it was all about what worked, what made money and that was the simple stuff. I’m sure we’ve all been guilty in the past of dismissing a strategy because it seemed too simple or perhaps we’ve overcomplicated a strategy, I know I’ve done both but it’s a good idea to keep simplicity in mind.

- I really liked the concept of Constant Proportion Portfolio Insurance, which aims to limit drawdowns and maximise growth under the constraints of the drawdown level. If you’re in a situation or you have a preference to limit drawdowns to a specific level, this could be a great strategy to employ.

- I also found his comments on Momentum crashes interesting. Momentum strategies can take a while to recover after a financial crisis and he suggested one way to manage that was by trading mean reversion strategies as well.

Got A Question, Topic or Guest you want to see on the Podcast?

Do you have a specific question, topic or guest you’d like to see on a future podcast episode?

Click here and submit your suggestion for a chance to have it featured on an upcoming podcast episode.

Get the Transcript

Subscribe to Better System Trader and never miss another episode!

Please support the podcast by giving an honest Rating/Review for the show on iTunes!