Market Internals student Christopher sent us an update on his progress applying the exclusive Market Internals Smart Code to one of his strategies:

Market Internals student Christopher sent us an update on his progress applying the exclusive Market Internals Smart Code to one of his strategies:

“Well, I finally got to applying it to my ES strategy, and the results are awesome. Just take a look for yourself. Every single metric has improved, and more importantly, the Max DD which is what we need. Took just over 1h, but well worth it. No depressing DD with this current high VIX.”

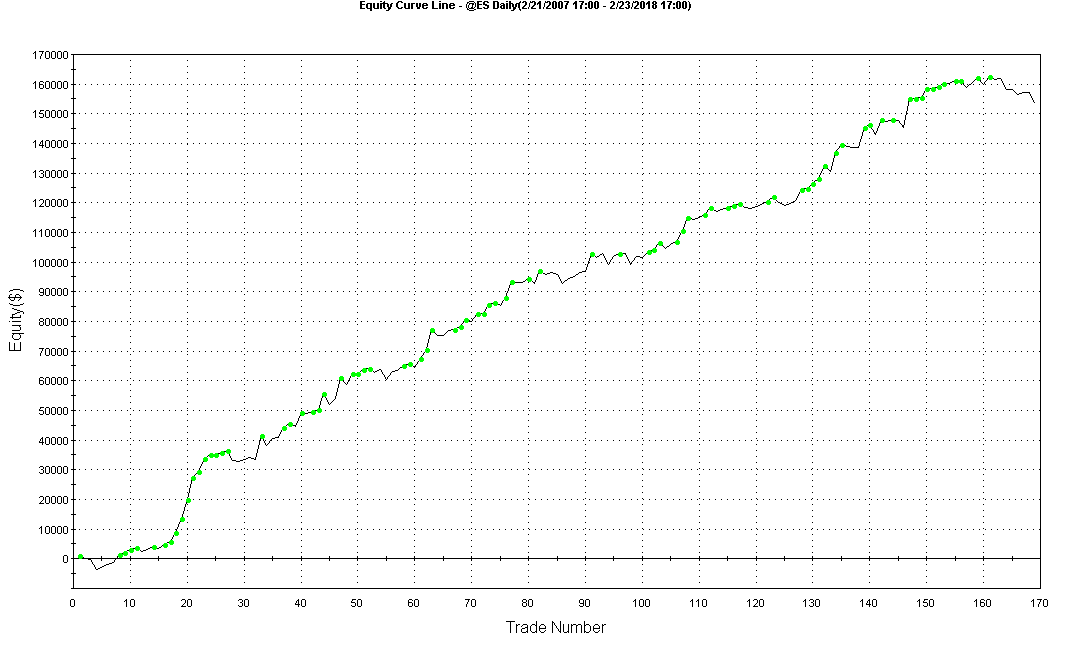

Before using Market Internals, the equity curve for his ES strategy looked quite nice already, but he had some concerns about the Drawdown:

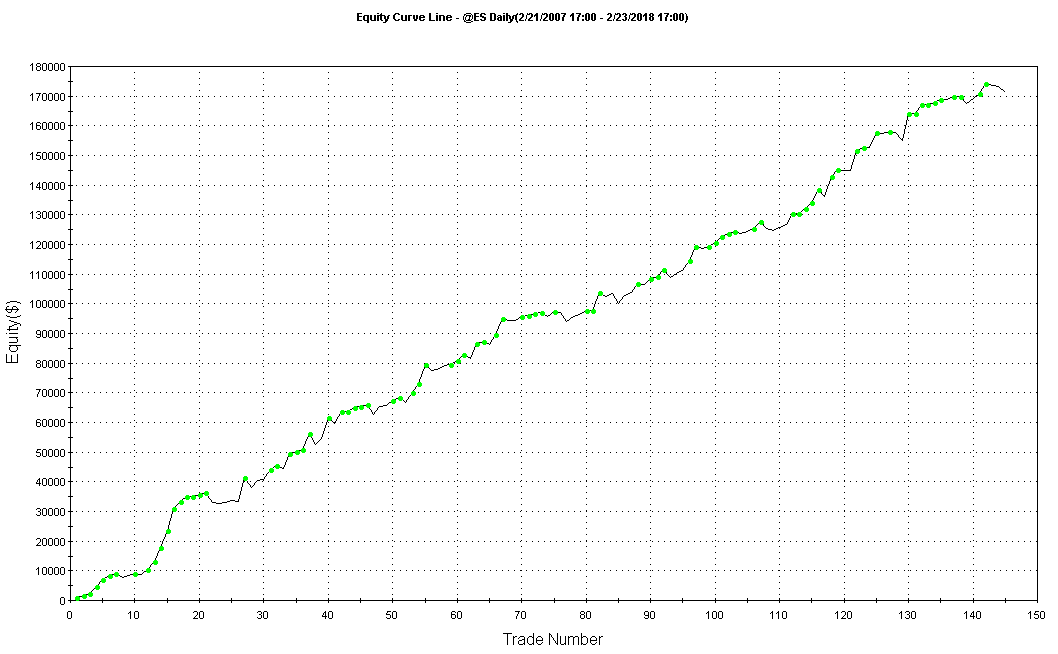

But after applying one of the 32 exclusive Market Internals filters included in the Trading Market Internals program, the equity curve improved even further:

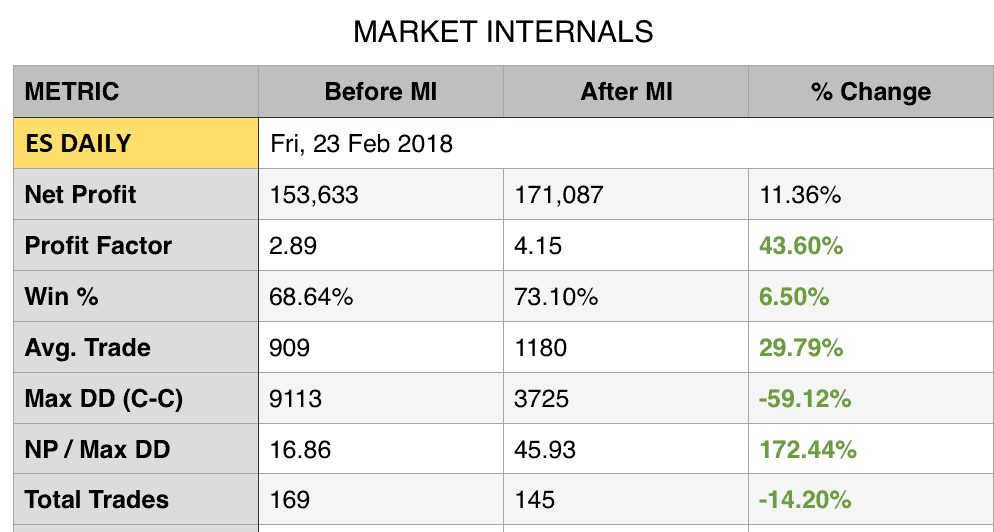

Let’s take a look at the actual performance statistics to see what’s really happening here:

From the table above we can see that every single metric has improved, including an increase in Net Profit, Avg Trade and Win%, plus a 60% reduction in Drawdown – and all with 30% less trades.

So how does it work?

Here’s Tomas Nesnidal (creator of the Trading Market Internals program) to explain:

“When a trader creates a strategy that has a drawdown that is a little high for his personal risk profile, very often the default behaviour is to optimize the strategy more, or try adding different filters to reduce the drawdown, however this can quickly lead to overoptimization and curve-fitting if the trader is not careful.

The benefit of using Market Internals is that it’s an additional data source that can help you to assess the underlying strength or weakness in the market, which is not always visible on a price chart (until it’s too late…).

Having this additional data as part of a trading strategy can significantly improve performance by only letting the strategy trade in the most suitable market conditions.

It works great for entries, exits, trade management, market regimes and money management too, plus it’s simple to apply when you know how to do it properly.”

Now of course Market Internals techniques don’t work for all strategies (nothing does), however we’ve seen many students experience similar results to Christopher, with improved performance in all types of trading styles and timeframes.

But don’t take our word for it – prove it to yourself:

If you trade index futures or stock strategies and want to see what Market Internals can do for your trading, check out the case study (with EasyLanguage code so you can prove it to yourself) at tradingmarketinternals.com

Cheers,

Andrew.

Are you looking for a proven solution to CUT DRAWDOWNS and significantly improve the performance of your trading strategies?

Get your FREE Market Internals Online Starter Kit NOW before it disappears again

Released:

28 February 2018