Back in Episode 32 we had a chat with Laurent Bernut, a systematic short seller who spent years working in the Hedge Fund world specializing in short selling strategies.

He shared loads of knowledge with us in that episode but we actually had a lot more to talk about. We ran out of time back then so in this episode we’re going to continue with the chat, covering a bit more on short selling, including common problems and mistakes traders make when short selling, the 5 psychological stages of a bear market, how these stages manifest in market behavior and where we are now.

We also chat about his Convex position sizing model, visualizing your trading edge and how to tilt it more in your favor PLUS he shares with us a special trick to switch our minds from a flight or fight mode back into a state of flow.

We also have some great questions submitted by podcast listeners so listen out for those.

Sponsor

Topics discussed

- Common problems traders face when short selling

- When to never short a stock

- The 5 psychological stages of a bear market, how they manifest in the markets and where are we now?

- How Laurents Convex position sizing model adapts position size differently in periods of performance and drawdown

- Visualizing your trading edge and tilting it in your favor based on trading style

- The main components of a short trading strategy

- Why a break of support is often not the best place to enter a short trade and what to do instead

- A simple ‘jedi mind trick’ that switches your mind from fight or flight into a flow state

Resources mentioned in this episode

- Laurent can be followed on his website Alphasecurecapital.com or on Quora

- Recommended books:

Show your support

While you’re listening, it would be great if you could show your support by leaving a brief review of the podcast in iTunes. This really helps to spread the word and reach even more listeners!

Free download – Trading Edge Visualiser

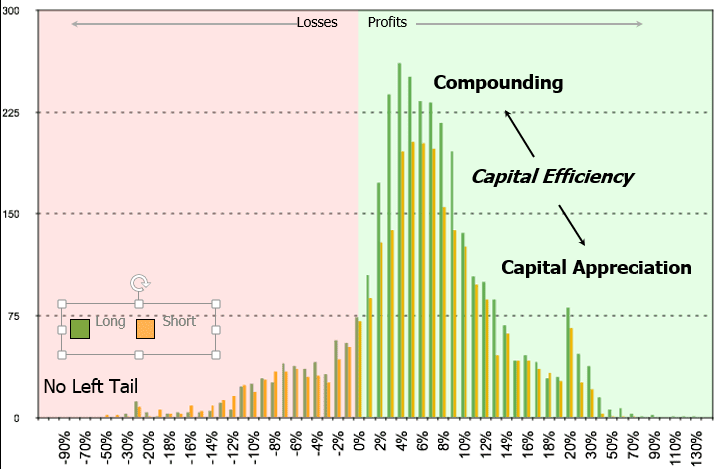

In this episode Laurent discusses more on trading edge and how visualizing it can help find ways to tilt it in your favor.

Download a free copy of the Trading Edge Visualiser tool Laurent uses for his own trading:

Quotes

Top tips from this episode

Here are few of my favourite takeaways from the chat with Laurent this week:

- Convex position sizing model – I found this technique of position sizing quite an interesting approach to reducing position size in a drawdown and increasing it during periods of good performance. Laurent is planning to write up some more information on this approach, I’ll include a link to it on this page once it’s available.

- Trading Edge Visualizer – This is the actual excel spreadsheet Laurent uses to measure the shape of his P&L distribution, which as Laurent mentioned in our chat can help to identify areas for improvement depending on strategy style. You can download a copy of the actual tool from his website, the link is above.

Got A Question, Topic or Guest you want to see on the Podcast?

Do you have a specific question, topic or guest you’d like to see on a future podcast episode?

Click here and submit your suggestion for a chance to have it featured on an upcoming podcast episode.

Get the Transcript

Subscribe to Better System Trader and never miss another episode!

Please support the podcast by giving an honest Rating/Review for the show on iTunes!