In my interview with Laurent Bernut in Episode 32, Laurent made the statement:

A number of listeners asked what he meant by this and he was glad to explain a little more, so here it is direct from Laurent:

Sharpe was the right answer

First, let’s start with what Sharpe does well. There are two things it does well:

- Cross-asset unified measure: we all know that the most important component in alpha generation is asset allocation. Now, the difficulty is to have a single measure of risk adjusted measure of alpha. This is where Sharpe did the job. It could give a single number across many asset classes: be it fixed income, equities, commodities etc.

- Uncertainty: the human brain is hard wired to associate uncertainty with risk. It triggers the amygdala and activates the fight, flight or freeze reflex (see one of my posts about fear and greed). So, Sharpe is a good measure of uncertainty: it quantifies units of uncertainty adjusted performance.

Now, Sharpe ratio, as part of the modern finance package, was invented the same year of the coronation of the Queen of England. It was good, almost revolutionary for its time, since Batista in Cuba was fighting El Che and Fidel. But, like the UN building designed by Brasilian Oscar Niemeyer, it did not age well, and here is why:

Sharpe is not a measure of risk, it is a measure of volatility adjusted performance

It associated volatility with risk. Risk does not equate volatility and here are a few examples:

- Low vol may be extremely risky: LTCM had low vol. In fact, their strategy was to be short gamma. It worked until it did not. Fast forward 2008, vol funds collapsed one after the other. Low vol does not equate risk.

- CTAs like Ed Seykota, Tom Basso, Bill Dunn, William Eckhardt etc: they have supposedly hopelessly low Sharpe but have clocked >+25% year in year out.

Does it mean that the CTAs have risky strategies ? No, it means they have low semi-volatility adjusted strategies. Semi-vol is just downside volatility.

Risk means uncertainty, just learn to get comfortable with it

As much as I understand that uncertainty is not pleasant and may trigger some reptilian alarms in our brain, we must learn to live with it. It involves mindfulness meditation, strict formalisation of strategies etc. Do not pray for an easy life, pray for the strength to endure a tough one.

Now, what is risk ?

Risk is not a paragraph at the end of a dissertation. Risk is a number. The only difficulty is to find the adequate formula that goes along. There are two types of strategies: mean reversion or trend following. Please read my posts on the subject.

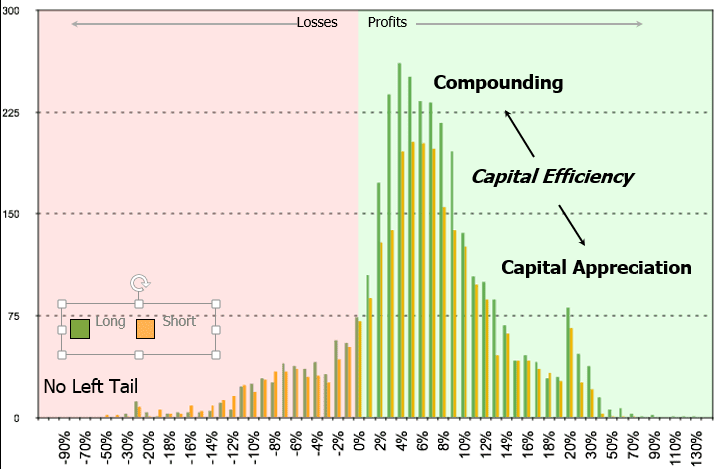

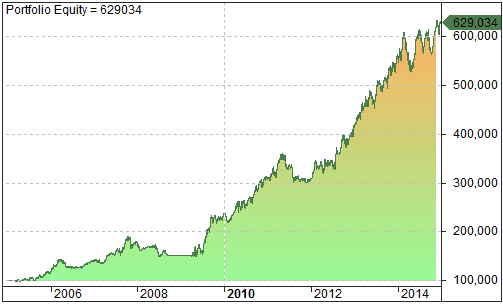

Risk is not difficult to quantify. It is only difficult to identify. I have come up with the common sense ratio as it recaptures both mean reversion and trend following strategies.

CSR = tail ratio * gain to pain ratio

Please use the trading edge visualiser to find out your personality:

Conclusion

Bottom line, we have associated risk with volatility. We have come up with a measure of volatility adjusted performance and deem it a risk measure. CSR, on the other hand, is a unified risk measure that can be used across asset classes. It measures risk according to strategy type.

Please subscribe and get some files, material and resources. This is all free so take advantage of it.

— By Laurent Bernut of Alpha Secure Capital.

[shadowbox]Laurent Bernut, Founder & CEO of ASC, has worked in the alternative investment space at Fidelity Investments, Rockampton, and Ward Ferry, for 14 years. For the past 8 years at Fidelity, his mandate as a dedicated short seller was to underperform the longest bear market in modern history: Japan equities. Laurent’s Research and Trading Systems to generate alpha in the alternative space has been built over 14 years. For more information please visit Laurents website alphasecurecapital.com[/shadowbox]