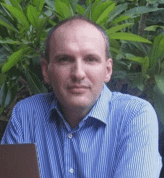

We’ve been very lucky to have a number of trading champions on the podcast before and this episode we get to talk to another champion trader, Michael Cook, who won the World Cup Championship of Futures Trading®* in 2007 and 2014 and the World Cup Championship of Stock Trading®* in 2011.

Michael worked in the institutional world for a number of years before leaving behind the banks and hedge funds to trade for himself.

In this episode we’ll be discussing how to maximise returns, using the market to determine stop levels, selecting a position sizing algorithm and the role of discretion in systematic trading.

In this episode we discuss

- How a short statement from Larry Williams influenced Michael to enter the World Cup Trading championship and what we can all learn from it

- How Michael won the trading championship multiple times and the unexpected benefit of winning

- A method Michael used to maximising returns

- Why market related stops make more sense that a fixed cash amount

- Position sizing algorithms and why fixed fractional is often the best approach

- How to recognise conditions that could cause a strategy to fail before it actually does

- Hard and soft stops, and how to consider the risk of each

- The role of discretion in systematic trading

- Occasions where it make sense to override trading strategies – being more trader than system purist

- Where to find trading ideas

Sponsor

Show your support

While you’re listening, it would be great if you could show your support by leaving a brief review of the podcast in iTunes. This really helps to spread the word and reach even more listeners!

Resources

- Michael can be contacted by email on [email protected]

- Recommended books:

Want to hear more from Michael and 3 other champion traders?

Don’t miss this incredible event, the Trading Masterclass of 2016:

Sounds great, give me more info!