Ralph Vince is a trading systems expert who has been programming trading systems for fund managers, sovereign wealth funds and staking systems for “professional gamblers,” since the early 1980’s, working as a personal programmer to legendary traders like Larry Williams.

He is a recognized authority on position sizing in trading and has written numerous books and professional papers on money management for trading, introducing new statistical techniques that are in widespread use throughout the industry today.

Today we talk all about position sizing, how to choose a position sizing model that suits you, optimalf, the curve and how it can be used for maximum growth and other applications. We also discuss the risk of multiple strategies in a portfolio and how to manage it, dynamic position sizing, martingale strategies and how Ralphs views on money management has changed in the past 25 years.

Topics discussed

- The single biggest factor in trading

- The most important factor when determine position sizing

- How horizon impacts position sizing

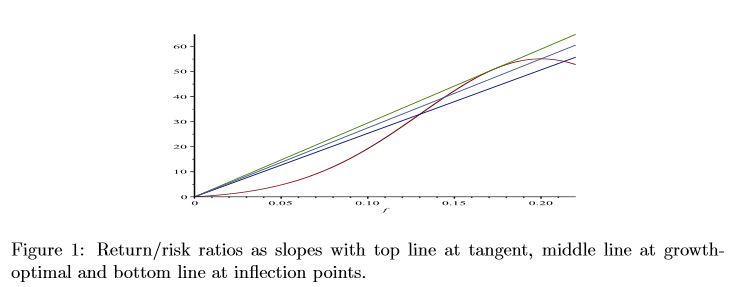

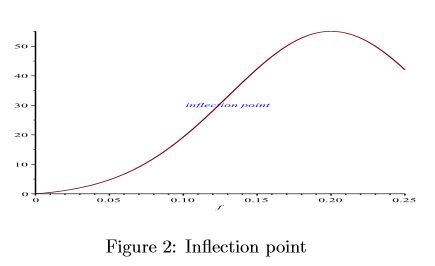

- How Optimalf is only one point on the curve and other critical points you also need to consider

- Traversing the curve and how it applies to your trading criterion

- How to manage a portfolio of multiple strategies

- The risk of multiple strategies and how to manage it

- Trading the equity curve

- Dynamic position sizing

- When Martingale strategies make sense

- How Ralphs views on money-management have changed in the past 25 years

Resources mentioned in this episode

- To learn more about Ralph and his work, checkout his websites Ralph Vince and LSP Indexes.

- Recommended Books:

- Plus some more books by Ralph:

- Risk-Opportunity Analysis – Ralph Vince

- The New Money Management: A Framework for Asset Allocation – Ralph Vince

- The Mathematics of Money Management: Risk Analysis Techniques for Traders – Ralph Vince

- Portfolio Management Formulas : Mathematical Trading Methods for the Futures, Options, and Stock Markets – Ralph Vince

- Additional Resources:

- IFTA article by Ralph Vince

- A Leverage Space Primer by Ralph Vince

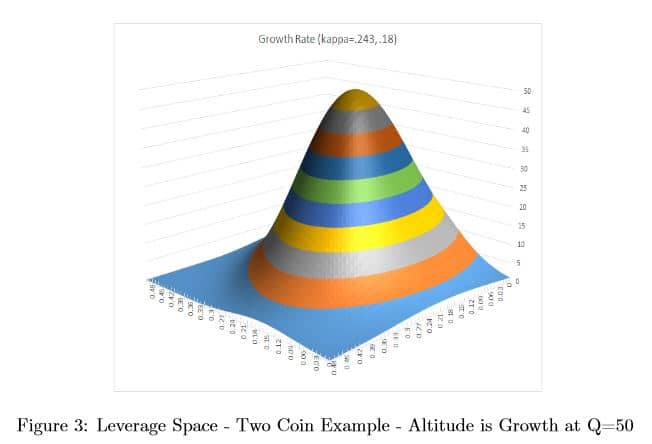

- The following images are from Ralphs research paper Optimal Risk Budgeting under a Finite Investment Horizon, which demonstrate the concepts discussed in this episode:

Quotes

Top tips from this episode

- You really need to understand your criteria, can you define what you’re trying to achieve? Whether you’re aiming for maximum growth, limited drawdown or somewhere in between you really need to define exactly what it is you’re trying to achieve. Ralph said the biggest impediment was not being able to articulate the criteria.

- Define your horizon – another point that goes with criteria is being able to define your horizon as your position sizing will vary depending on how many periods you want to achieve your outcome.

- Traversing the curve to meet objectives – we’re all aware of the optimalf point, which is the peak of the point for maximum growth, but there are also other critical points on the curve that may be more appropriate depending on your criteria.

Got A Question, Topic or Guest you want to see on the Podcast?

Do you have a specific question, topic or guest you’d like to see on a future podcast episode?

Click here and submit your suggestion for a chance to have it featured on an upcoming podcast episode.

Get the Transcript

Subscribe to Better System Trader and never miss another episode!

Please support the podcast by giving an honest Rating/Review for the show on iTunes!