Do any of these sound familiar to you?

- Are you looking for a step-by-step procedure on how to perform a back test, including what to look for?

- Do you ever feel like you’re poking around in the dark when trying out new strategies, and wondering if there is a better way?

- Have you developed systems that were not profitable in real trading and all they did was drain your trading account slowly… but steadily?

- Do you lack confidence that the processes you’re using for testing and evaluating systems are robust enough to ensure that the systems will perform sufficiently when traded live?

It’s enough to drive anyone crazy!

If so, then you’re in the right place!

At Better System Trader, we’ve interviewed many of the top traders around, uncovering the tips and techniques they use to approach the markets, and we’re sharing them all with you.

There is alot of valuable information on this site and it can be hard to know where to start so over the next week or so we’ll be sending you a few short emails with a roadmap you can follow to build better strategies that last.

Step 1

Building better strategies has been the focus of many of our podcast episodes.

In fact, you’ll find strategy creation tips in most episodes.

However, one of the most popular and valuable episodes was Strategy Creation and Optimization with Robert Pardo.

Bob Pardo has been in the industry for almost 40 years.

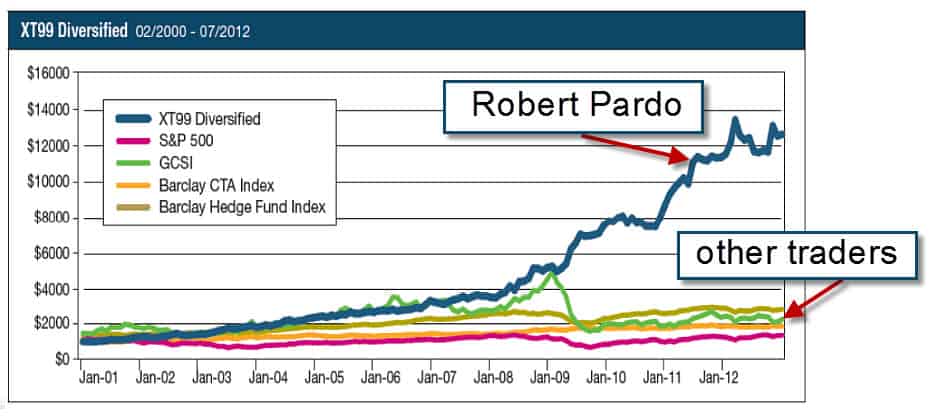

He’s the president of Pardo Capital, which has produced some outstanding performance – Take a look at these audited results of his ‘XT99 Diversified’ trading program:

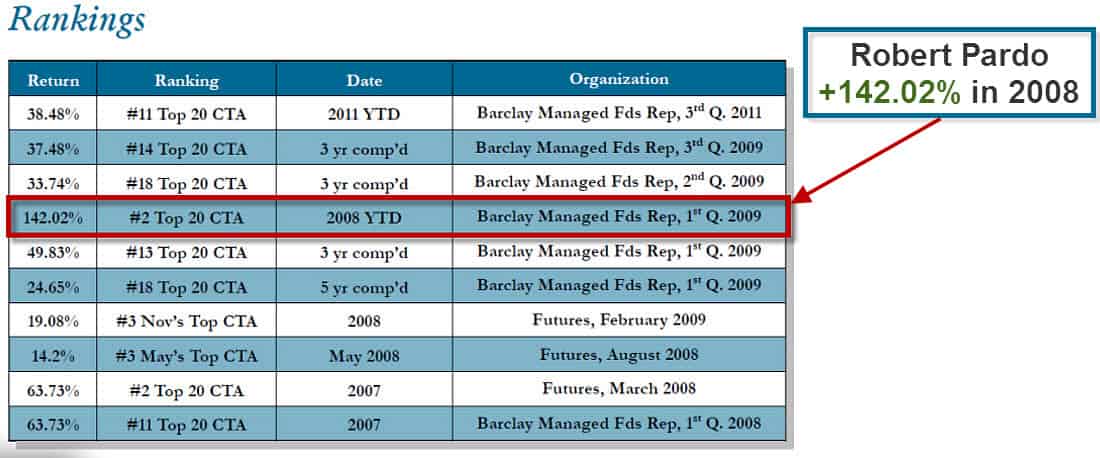

Bob has won a number of awards too, including Futures Magazines ‘Trader of the Year’ for an outstanding 142% return:

Plus he introduced the trading world to Walk Forward Analysis, a technique that is now used by many of the world’s top traders and money managers.

In a nutshell, he know’s what he’s doing!

In this episode, Bob shares insights on creating and optimizing strategies that are robust and continue to work in the future, including:

- Common mistakes traders make that can cause strategies to fail in real-time trading

- The dangers of traditional optimization techniques and how they can be reduced and even overcome

- How to determine if a strategy really is robust, while keeping it fresh and adapting to market conditions

This episode is a gold-mine of strategy creation tips and techniques, so you don’t want to miss it!

Watch out for the next email where you’ll get even more practical tips to building better trading strategies that last.

Cheers,

Andrew.