Have you ever wondered how hedge funds manage the tradeoffs between simplicity and complexity to generate safe, consistent returns?

In this week’s episode of the Breakout Trading Answered show, we discuss the exact process Mr. Breakouts uses in his hedge fund to optimize strategies and portfolio performance.

It’s called “The #1 Hedge Fund Optimization Secret”… and it applies to individual trading accounts, too!

Here’s just a small sample of the topics we discuss on the show:

- Cutting through the confusion around optimization

- Mr. Breakouts pushes the audience out of the box and breaks a strong paradigm

- Complex strategies vs simple strategies: which is best?

- The Halo Effect and how it impacts trading results

- Should we avoid Parameter-less filters or are they as good as people say?

- Full details of the number one hedge fund strategy optimization secret

Episode Highlights:

00:28 Optimization Paradigm Shift

07:56 Complex Strategies vs. Simple Strategies

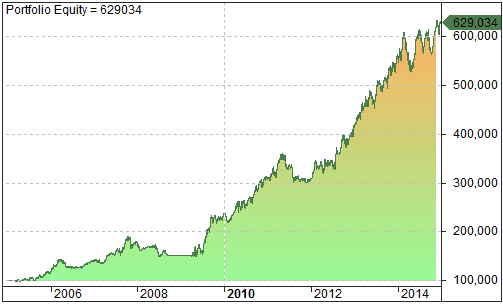

08:40 Analysis of the Results

12:23 Parameter-less Filters

14:29 The Halo Effect

16:13 The importance of stress testing

17:14 The secret to hedge fund optimization

Click here to check out the BTA YouTube channel for more great trading content.

Released: April 6, 2023