Most traders lose money because of simple “trading traps”.

Here’s 5 common traps that can destroy traders, and how to overcome them for more consistent (and confident) trading:

The Get Rich Quick Trap

Humans have a tendency to want to get rich quickly.

If your position size is too large, you’ll likely suspend trading during your biggest drawdown.

Understand the power of compounding over time.

The Overestimation Trap

Your largest drawdown is in the future.

Whatever you think you can handle in volatility and drawdowns, cut it in half. Do not overestimate your abilities.

Be a risk manager first, stay in the game.

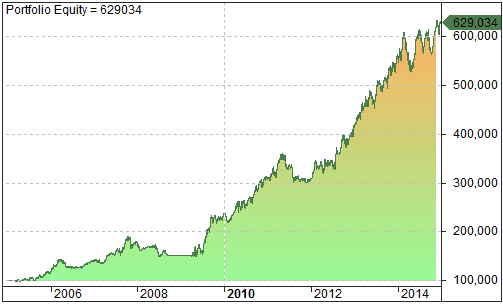

The Equity Curve Trap

Don’t just use backtest reports for the beautiful equity curves.

Zoom in to understand when your strategy is supposed to make money and when it is likely to lose.

That knowledge will make your life so much easier.

The Excitement Trap

Traders should be completely detached from day to day results.

That’s only possible by lowering risk to a level you’re truly comfortable with. Trade execution should be boring, not exciting.

Be a risk manager first, trader second.

The “1 and Done” Trap

A single trading strategy won’t perform well all the time.

Don’t rely on one strategy for profits.

Diversify for consistency:

-> trade Long and Short

-> mix strategy types -> Trend Following vs Mean Reversion

-> vary strategy rules

Full Interview

Watch my full discussion with Laurens Bensdorp:

Click here to check out the BST YouTube channel for more great trading content.