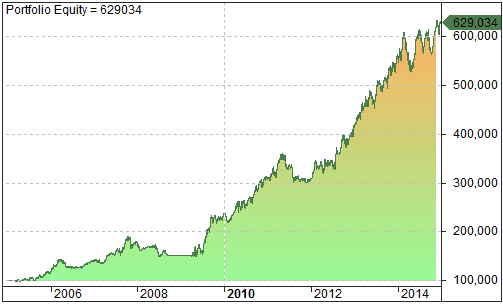

In 1987 Larry Williams turned $10,000 into $1.1 million.

That’s a cool 11,000% return…

And the all-time record in the World Cup Championship of Futures Trading.

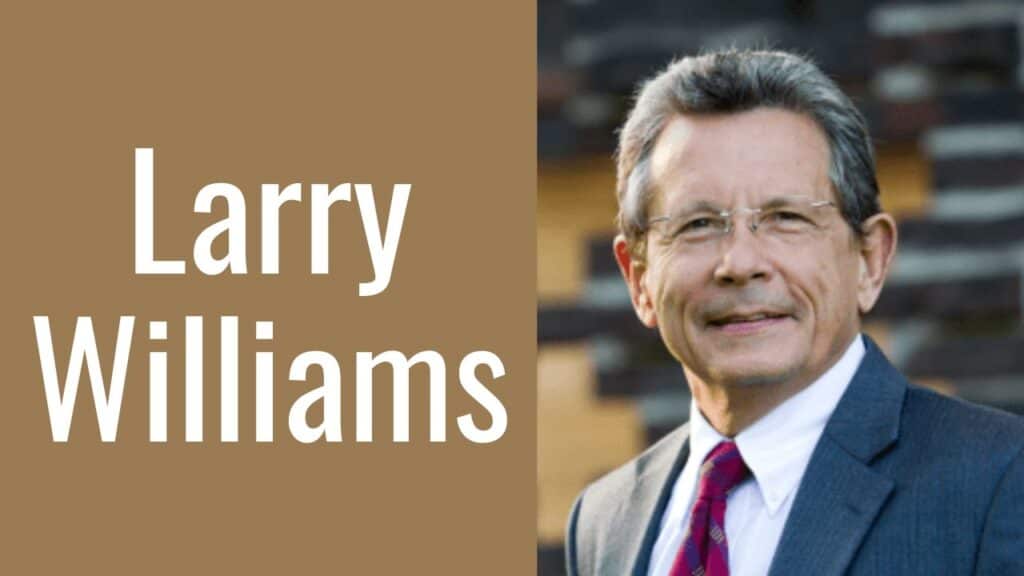

So, how does a trading champ use indicators?

Here’s 6 tips Larry shared on how to use indicators effectively:

1. Most indicators are redundant

Many indicators provide similar information.

Using multiple redundant indicators can clutter the analysis without adding value.

2. Indicators need a purpose

Indicators should serve a specific purpose, such as measuring accumulation, trend, or cycles.

It’s essential to understand what each indicator is designed to measure and use it accordingly.

3. Use less indicators

Fewer indicators can lead to more effective analysis.

Overloading charts with too many indicators can lead to confusion and poor decision-making.

Less is more.

4. Multiple indicators to confirm

Successful trading often needs multiple conditions to confirm a trade.

Combining fundamental conditions with technical indicators can enhance the reliability of trade signals.

Use indicators that look at the market from different angles.

5. Indicators decline

Markets evolve.

What worked a decade ago may not be as effective in the markets today.

Traders should evaluate and adapt indicators when necessary.

6. Avoid indicator over-reliance

No single indicator is foolproof.

Relying too heavily on one indicator can lead to poor trading decisions.

Use a balanced approach, incorporating multiple indicators and other forms of analysis.

With these 6 tips, indicators can be a powerful tool in your trading arsenal.

Full Interview

Catch my full discussion with Larry here:

Click here to check out the BST YouTube channel for more great trading content.