VIX is often used as a market timing indicator for the S&P.

But are traders using it wrong?

Is there a better way?

Here’s 3 insights from my chat with Rob Hanna Quantifiable Edges on “New Volatility Based Trading Techniques”:

1. Conventional wisdom

The VIX and S&P tend to move inversely to each other.

Traders often use VIX signals to time the S&P.

2. Short-Term Predictors

Just using the S&P to time itself actually works better than using the VIX to time the S&P.

Also, short-term indicators for the S&P are better predictors of VIX movements than VIX can predict the S&P.

3. Faster recovery

VIX recovers faster than the S&P.

Traders can use this shorter recovery to reduce the length of drawdowns.

“Short and hold” in the VIX has much shorter drawdown periods than “buy and hold” in the S&P.

4. Example

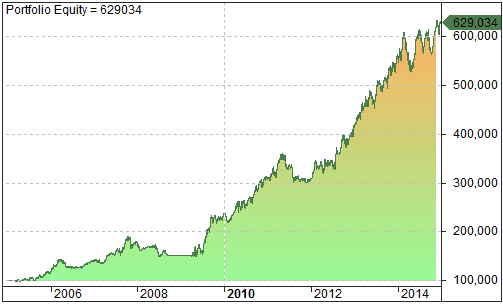

Here’s an example showing a VIX trading model based on S&P signals:

While the VIX can be useful in timing the S&P, there may be more value in using the S&P to time VIX.

Doing so could reduce the length of drawdowns.

Full Interview

Watch my full discussion with Rob:

Click here to check out the BST YouTube channel for more great trading content.